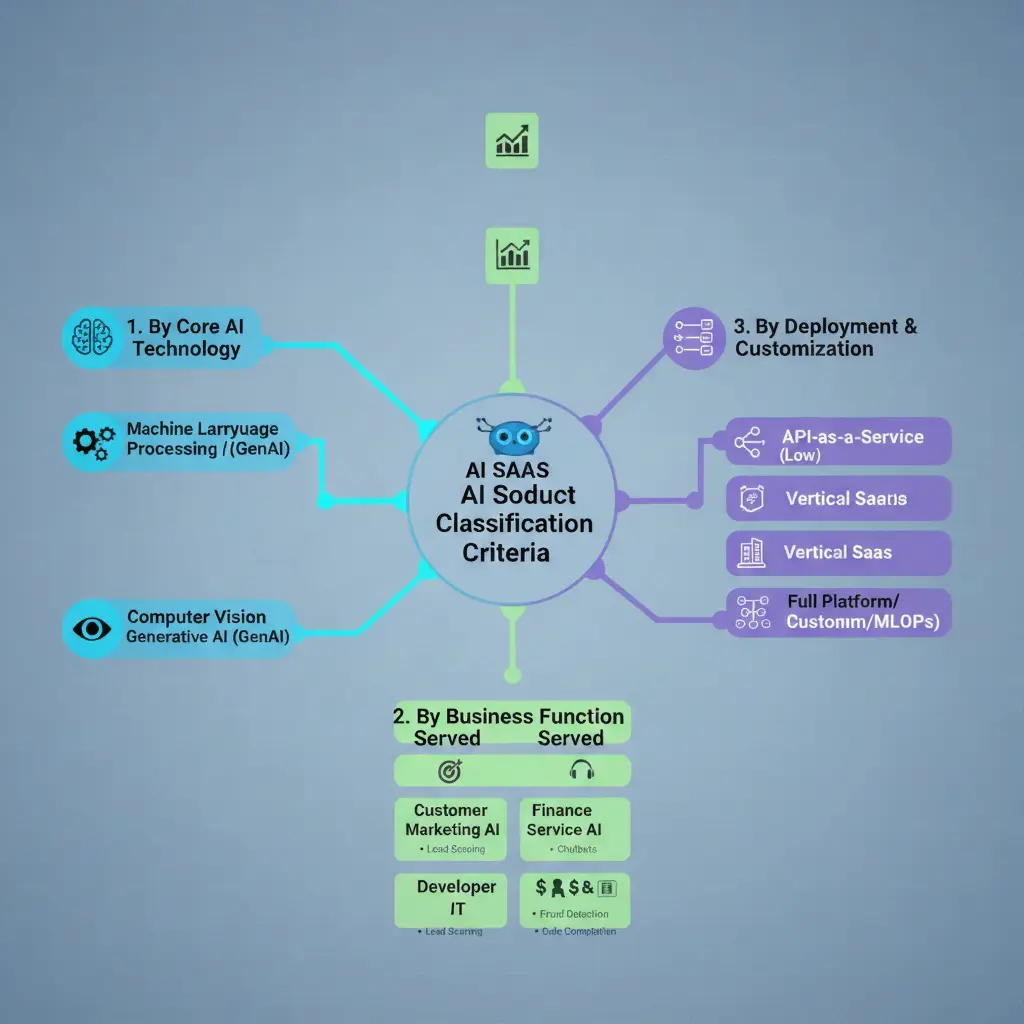

The artificial intelligence software market is proliferating rapidly with very high expectations, as it is supposed to grow from $115 billion in 2024 to nearly 3 trillion by 2034. However, a very important question has surfaced amid such growth: how can we correctly identify and judge these multifarious solutions?

It doesn’t matter if you are a founder trying to present your product in the best light, an investor assessing potential opportunities, or a business choosing the most suitable tool, being aware of the criteria for classification gives you an enormous advantage. The issue goes beyond merely tagging products—rather, it revolves around providing transparency in a market that is getting more and more populated, where every tool claims to be “AI-powered.”

The reality is, there are several solutions that do not warrant that label. There are some products that have machine learning embedded in them, while others are merely attaching artificial intelligence to their existing software by means of adding a chatbot. Such a difference is very important when you are making decisions regarding product development, investment, or technology adoption.

Why Classification Criteria Matter More Than Ever

Imagine the last time you looked for customer relationship management software. You most likely saw many options with each of them boasting some unique benefits. Once artificial intelligence is put into the equation, the whole thing gets multiplied by a high factor of complexity.

Correct categorization has many important functions to perform. For product groups, it not only makes the positioning clearer but also assists in recognizing the actual competitors instead of just the surface ones. The investors are provided with the specificity that they require to assess the existence of strong defenses, as well as the likelihood of growth being realistic. Corporate buyers can tell apart strong, critical-to-their-business solutions from only the marketing gimmick of sophisticated features over the core everyday uses.

Misclassification leading to wrong positioning has far-reaching effects beyond just creating confusion. Over time, companies that place themselves wrong usually face the problem of longer sales cycles, unclear messaging, and inability to attract the right customers. On the other hand, those possessing very clear classification systems will enjoy rapid growth, be able to charge higher prices, and gain stronger investor confidence.

Core Intelligence Layer: What Powers Your Product

The very first step of any classification system is to get a clear view of the technology underneath it. By this, we do not mean to explain it with technical terms but rather to know what the product’s intelligence is based on.

A system of machine learning learns the data patterns at a very slow pace over time, and thus, it is one of the very few products that get better and better by just processing more and more information, so they can be used effectively in making predictions, fraud detection and the like. The tools for natural language processing (NLP) are able to comprehend and produce human language and thus support everything from sentiment analysis to content generation. Computer vision systems are capable of recognizing and interpreting visual information and they find application in quality inspection, medical imaging, and security feature.

The newest possibilities of machine learning are in generative models, which can produce entirely new and varied content across various media formats – from text to code – and all this based on the patterns they have learned. For every technology type, a different data strategy, infrastructure investment, and use case application must be in place. Thus, the understanding of which one your product falls into dictates everything from your technical design to your marketing strategy.

The key here is to be able to tell when the implementation is just a surface one and when it is a real one: if you take out the AI element and the value proposition becomes unviable, then you have created an AI-native product. On the contrary, if the product still brings some value even if the features related to machine learning are shut off, then it is an AI-augmented solution. This difference is very much crucial and it impacts the way you develop, your market and how you position the product.

Integration Depth: How Central Is Intelligence to Your Value

AI integration varies across products, and identifying the exact spot where your product is positioned on the spectrum would help in clarifying competitive positioning and prioritizing development.

AI-first products are completely based on such technology; it is the product and not just a feature. Conversation analytics or AI coding assistants are some examples of this kind of product. Without the intelligence component, they lose their entire value.

AI-improved products are the ones that come in with traditional software and try to improve it effectively with machine-learning capabilities. Look at email tools with smart compose feature or sales tools with predictive lead scoring. The base product is bringing value, but AI is increasing its power.

AI-optional tools suggest the intelligence that can be available as an extra service or can be switched off. Users can turn on the features if they want but are not relying on them for main functions. This approach is best for those companies that are learning how to adopt AI or have a customer base with different levels of technical proficiency.

The levels of integration characterize different aspects like pricing, technical complexity, and market positioning. The native solutions normally are the most expensive but also have the most technical difficulties. The market for enhanced products is often wider as they are accepted by familiarity combined with innovation. Optional solutions are less risky but may not be able to stand out in the already crowded market.

Market Positioning: Horizontal Versus Vertical Strategy

The place of your product in the market significantly determines the scale of growth, the setting of competition, and the methods of attracting customers.

Horizontal solutions have extensive applications in many sectors—like project management, communication, or data analysis—just to name a few. Such products do enjoy the advantage of larger addressable markets but, at the same time, they have to deal with competition that is very fierce and in most cases, a large marketing budget is necessary just to be in the picture.

On the other hand, vertical solutions have specific sectors in mind and provide them with the required features. Medical diagnostic tools, legal documentation scrutiny software, and retail stock management systems are some examples of this concept. Compared to the overall market, the size of the vertical market seems smaller, but still, vertical products are the first ones to be adopted quickest, they get a premium price and they create strongholds through their deep knowledge of the industry.

The decision of positioning horizontally or vertically is not a definitive one. Numerous successful firms have gone the vertical way first, then the horizontal route once credible and well-researched technologies have been built up. Knowing your place on this path not only determines your present priorities but also the decisions about the long-term road map.

Deployment Architecture: How Your Product Reaches Users

The decision made regarding infrastructure has a direct impact on compliance abilities and total cost of ownership, thus making the deployment architecture a very important classification factor.

The solutions in cloud-hosted multi-tenants are the main software-as-a-service model with infrastructure sharing, cost efficiency, and quick scaling up. This is quite an effective method for most use cases but might be difficult in the case of highly regulated sectors or customers who need more than average customizations.

The use of a single-tenant system guarantees dedicated infrastructure for all customers, thereby solving the issue of security and compliance in finance, healthcare, and government sectors. Even though this model is more expensive and harder to maintain, it provides the customization and control that enterprise customers usually demand.

On-premise installations allow for complete control over the data and infrastructure by the customers, but at the same time, it requires a lot of technical support and resources. This option is still valid for organizations that have data residency rules and restrictions to follow or for existing infrastructure that the organization prefers to use.

In combination with multiple deployment methods, hybrid models offer a flexibility that can fulfill various customer needs. Knowing which model suits the requirements of your target market helps in avoiding expensive shifts and fast-tracking the sales cycles.

Data Strategy and Model Training Approaches

The way your product processes data has a significant impact on its capabilities, compliance, and competitive advantages.

The pre-trained models depend on large datasets to provide general capabilities that can be adjusted for particular applications. This method speeds up the time to market and decreases the cost of training but may not be able to capture the unique organizational contexts or specialized domain knowledge.

The custom-trained systems rely on proprietary data to create models that are specifically tailored to their needs. Although this strategy is costly in terms of resources, it offers solid competitive advantages and caters to use cases that are too complex for general models.

The continuous learning products get better with the constant user interaction and feedback loops. This feature is a huge differentiator but it requires meticulous design to keep up the accuracy while also not letting the model drift or bias.

The transfer learning and few-shot techniques are the new emerging middle grounds; that is they let the products quickly shape themselves for new areas without having to wait for much training data. Realizing which strategy is suitable for your product’s distinct characteristics will help in prioritizing the development plans and making technical investment decisions.

Key Takeaways: Building Your Classification Framework

The clarification of the classification of your product does not necessarily imply to the fitting into strict limits. It gives, in contrast, the vocabulary and the organization for effective communication of value across different groups.

Begin with a truthful examination of your main intelligence layer. Which technology exactly underlies your differentiation? Do not, for Example, claim generative abilities if your system is operating on rule-based automation. The more specific you are, the more credible you will appear.

Unfold the department of integration realistically. Can your product still be good without the ai components? This answer will determine everything from the pricing strategy to the technical architecture investments.

Think about market positioning with great care. Horizontal plays and vertical specialization will require different resources and timeframes. The success of either approach depends on good alignment with your capabilities and the opportunity provided by the market; none is superior.

Make deployment architecture choices that are non-traditional but based on customer requirements rather than on the purely technical side. Enterprise buyers in regulated industries, for example, need different solutions than those small businesses which only require functional plug-and-play tools.

Create a clear data strategy and document it. The training, updating, and improving of the models adversely affects both the development of the capability and the trust of the customers. It is better to be clear upfront than have to go through difficult conversations later.

As your product develops, keep your classification review on the schedule. An AI-enhanced tool which was once horizontal may now easily be vertical and thus AI-native. Allowing your classification system to mirror reality not only keeps your positioning true but also makes your messaging efficient.

What exactly defines an AI SaaS product versus regular SaaS?

A real AI SaaS product seamlessly incorporates technologies such as machine learning, natural language processing, computer vision, or similar ones that empower the software to learn from data, predict outcomes, or create content without human intervention. Standard SaaS might offer automation capabilities, but these usually obey fixed rules instead of changing according to data-derived patterns. The main test is to inquire whether the product’s fundamental worth relies on perpetual learning or on clever decision-making that gets better with time and does not require any manual programming updates.

How do I determine which classification criteria matter most for my specific product?

Initially, the main audience must be identified and their decision-making factors determined. Prospective customers from the enterprise sphere among the regulated sectors will put their emphasis on weak points of each architecture for deployment, compliance capacity, and clear reasoning. Three good reasons may be called by the investors: a secure position in the market, barriers against their competitors, and a good extent of growth. The same users would put it in a different way: they would talk about the features, integration hardships, and how much value taken as a whole.

Then it would be advisable to draw a map where the arrow of classification choices points to the stakeholders with their concerns who have the most influence on your success, and it would be wise to make your positioning to those priorities in a way that is both authentically and thoroughly covered.

Can a product belong to multiple classification categories simultaneously?

Certainly, and the majority of high-tech products do. A remedy could amalgamate predictive and generative abilities, work with both horizontal and vertical markets, or provide several utilization options. Instead of compelling a single classification of categories use a multi-dimensional framework that portrays your product’s complete profile. This method not only gives the most precise positioning but also aids in educating the various groups about the specific characteristics which are important to them, without simplifying the actual capabilities or the market fit.

How often should companies reassess their product classification as they scale?

In the high-growth phase, it is recommended to carry out classification reviews formally every three months at least. Once you have reached a product-market fit the minimum would then be two times a year. Major triggers for reassessment are introducing big features, entering a new market, changing the competition, or changing your technology. Classification should not, however, change the criteria lightly—repeated repositioning muddles your market. Your current capabilities should be represented truthfully while you maintain consistency customer and investor relations.

What are the biggest mistakes companies make when classifying their AI SaaS products?

The biggest blunder is to assert nonexistent AI functionalities or to overstate the part played by intelligence in providing value. This way of promoting the technology always turns against the company either in the course of technical due diligence or during customer implementations. Also, one of the other frequent mistakes is to over-categorize the products by inventing new classifications for very little feature differences, by not taking the existing market frameworks to which their product belongs into account, and by not matching the classification with the real customer demands and use cases. Keep in mind that classification is there to make things clear, not to confuse.

How does proper classification affect fundraising and investor conversations?

The investors distribute the funds according to the market size, competitive position, and how easy it is to defend—all these factors rely on correct classification. A well-defined product shows the company has a good understanding of the market, a realistic view of the competitors, and a well-thought-out strategy. Instead of pretending to be an all-around “AI platform,” the lucky entrepreneurs clearly define their position: “We are an AI-driven SaaS for manufacturing quality control with computer vision, working on a market of $12 billion with no leading company.” This type of statement not only creates faster investor trust, but also the process of confirming the deal takes less time and often results in a higher price because it reveals the company’s deep understanding of its true competitive situation.

What role does explainability play in AI SaaS classification?

Explainability—the measure of users’ comprehension of the AI’s decision-making process—stands out as a key dimension of the classification, particularly for the areas of regulation and risk applications. There are products that lie on the continuum between the completely clear rule-based systems in which every decision can be traced, and the opaque models where even the developers find it hard to give reasons for the particular output. The classification of AI by explainability facilitates the communication of risks to potential customers, guarantees obeying the laws, and connects the right solutions to the suited use cases. Financial services, healthcare, and legal applications are among the ones that usually need high explainability, whereas creative tools or recommendation systems might still function well with less transparency.